16 Nov Industrial Pomegranate Market Outlook 2025/2026

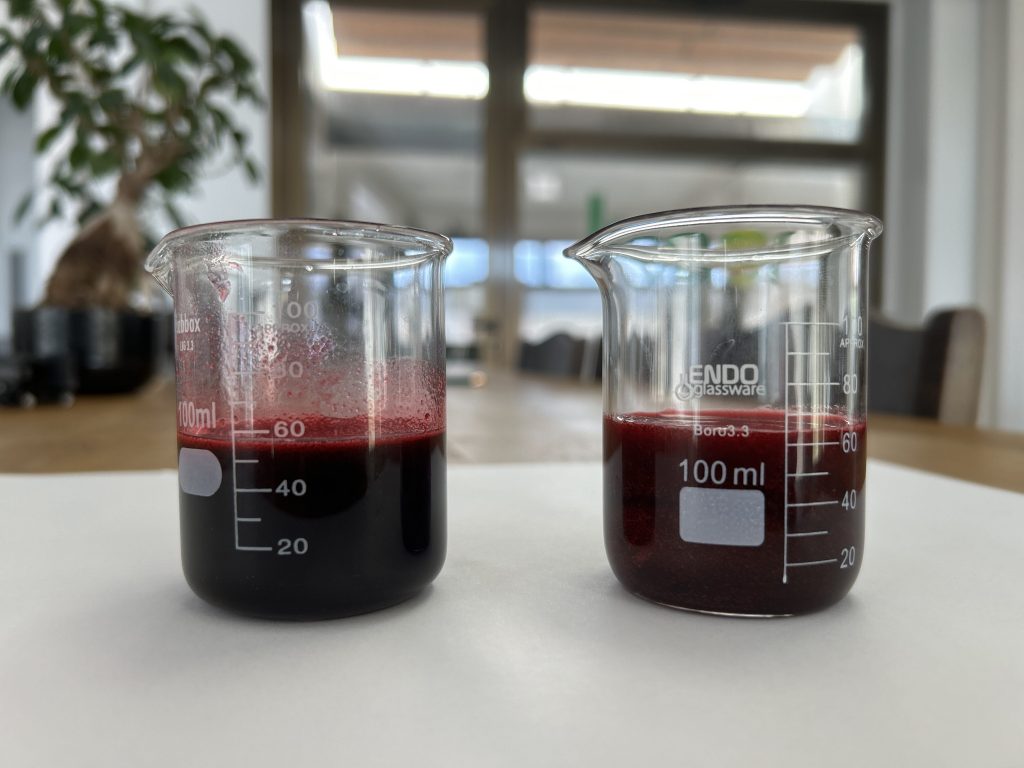

We are currently in the middle of the pomegranate harvest in Spain, and for some time now this fruit has been recognized as a key ingredient in functional beverages, concentrates, and industrial juices.

Global consumption of pomegranate juice has been growing at around 7% annually in recent years, and forecasts indicate that by 2029 growth will reach around 8% worldwide.

While the largest volumes come from regions such as the Middle East or the Southern Hemisphere, the Mediterranean—especially Spain—continues to strengthen its position not only for its moderate volume, but for its superior quality.

Spain: Mediterranean production with exceptional quality

For the 2025 / 2026 season, the estimated harvest for the PDO Granada Mollar de Elche variety is around 40,000 tons.

Broader national data place Spain’s total production at roughly 60,000 tons for 2025.

From an industrial perspective, this scale is more than enough to guarantee continuity and high-quality concentrate, supported by strict European food-safety standards

Turkey: large volume, industrial standard

According to recent estimates, Turkey’s 2025 pomegranate production stands at around 650,000 tons.

This makes it one of the Mediterranean’s major origins for pomegranate concentrate, although its varieties tend to be quite acidic, fitting better into standard beverage formulations.

Egypt: an emerging origin

Egypt’s production is estimated at around 200,000 tons.

Although its quality is more variable, the combination of volume and harvest window makes it relevant for industrial blends and supply contracts.

Why Spanish concentrate stands out

Sufficient volume and well-recognized varieties (Mollar, Valenciana) that offer stable color and flavor profiles.

Production under EU regulations: food safety, traceability, and contaminant control.

An ideal option for premium formulations or functional beverages where origin + “Mediterranean” add strong value.

A favorable autumn harvest window and strong technical know-how in cultivation, irrigation, and post-harvest handling, resulting in better yield and quality.

While Turkey and Egypt clearly lead in industrial volume, Spain provides a Mediterranean quality alternative that is extremely attractive to manufacturers looking for more than just a commodity — standing out thanks to its sensory profile, traceability, and premium positioning.

Sorry, the comment form is closed at this time.